Mortgage Broker Partnership

Digital Broker Experience

Applying for a mortgage is the most complicated and time-consuming task that a consumer experiences. They are increasing their reliance, trust, and confidence on independent mortgage brokers to guide them through the home loan process. Two in every three home loans are written by a mortgage broker, according to the Mortgage & Finance Association of Australia.

In turn, the mortgage brokers look for bank and non-bank lender partners that are easy to work with. They appreciate process transparency. Timely information and insights that boost growth prospects are important to them. They want their customers cared for. They prefer lender partners that engage with them in a convenient and efficient way.

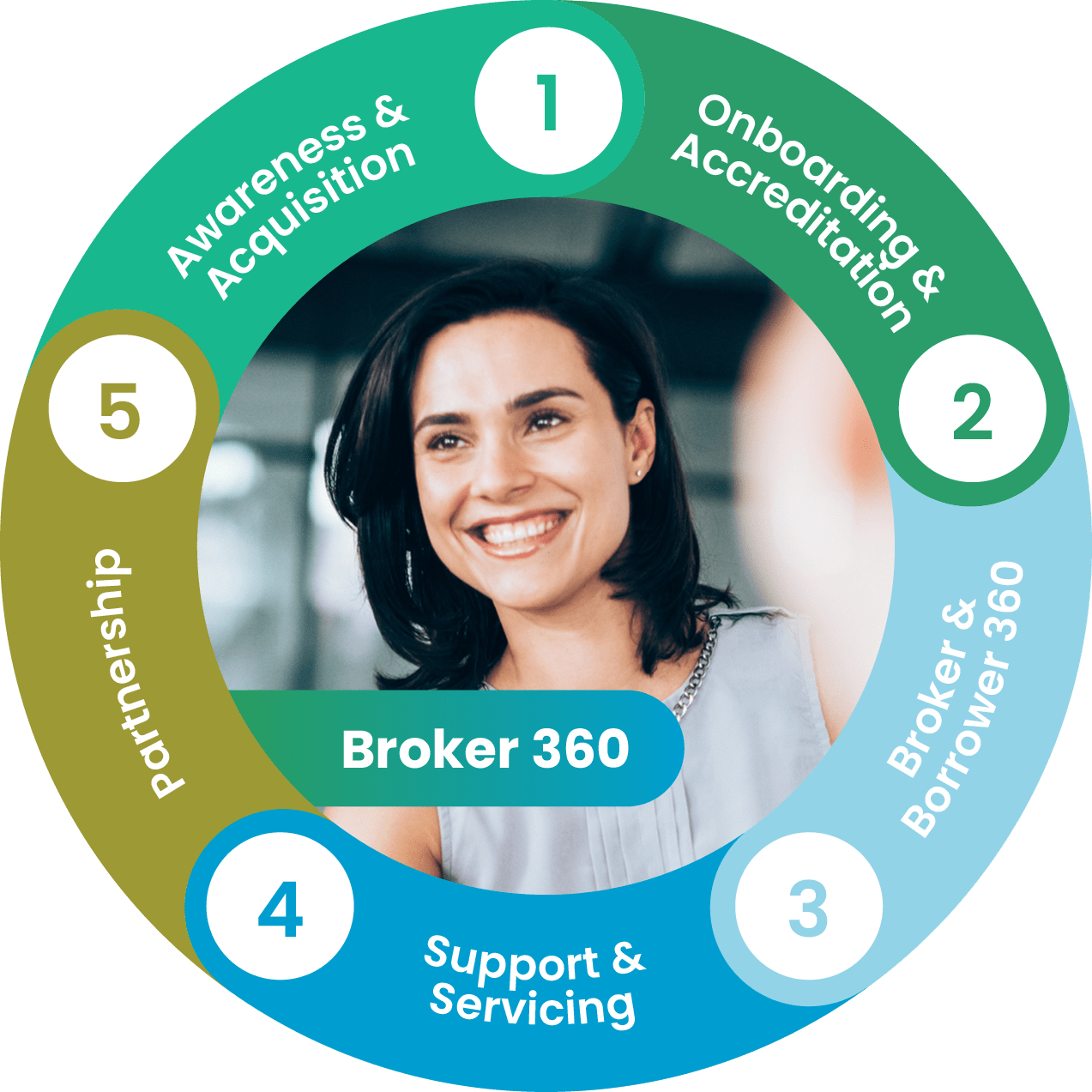

The Irada Mortgage Broker Partnership solution implemented using the Salesforce Financial Services Cloud, an industry-leading innovation platform, manages the full broker lifecycle from awareness to nurtured partnerships.

Engage better with your broker partners by creating a consistent, digital, and seamless experience. Give back productive selling time to your business development managers. Generate the capacity for higher settlement volumes.

We address your strategic business drivers that lift engagement, compliance, and volume. Together, we create a staged blueprint that matches your business priorities, investment envelope, and risk appetite. Our project execution is transparent, controlled, and with risks managed.

Mortgage Broker Partnership Solutions

Let’s talk!

Why not have a no-obligation chat with our Salesforce financial services experts? Explore how the Irada approach and solutions can help enhance your mortgage broker partnerships.